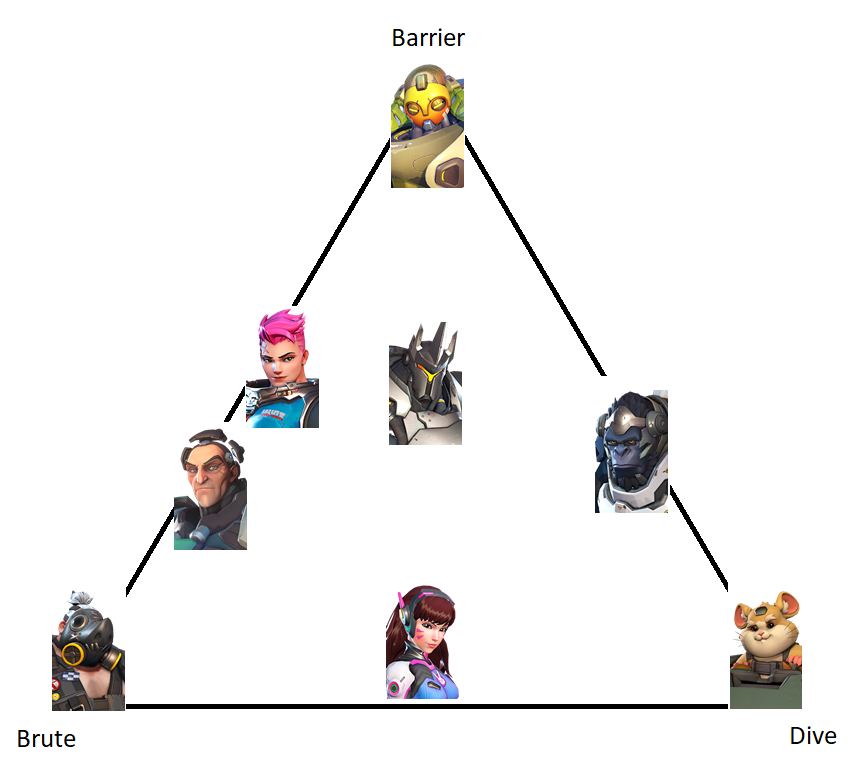

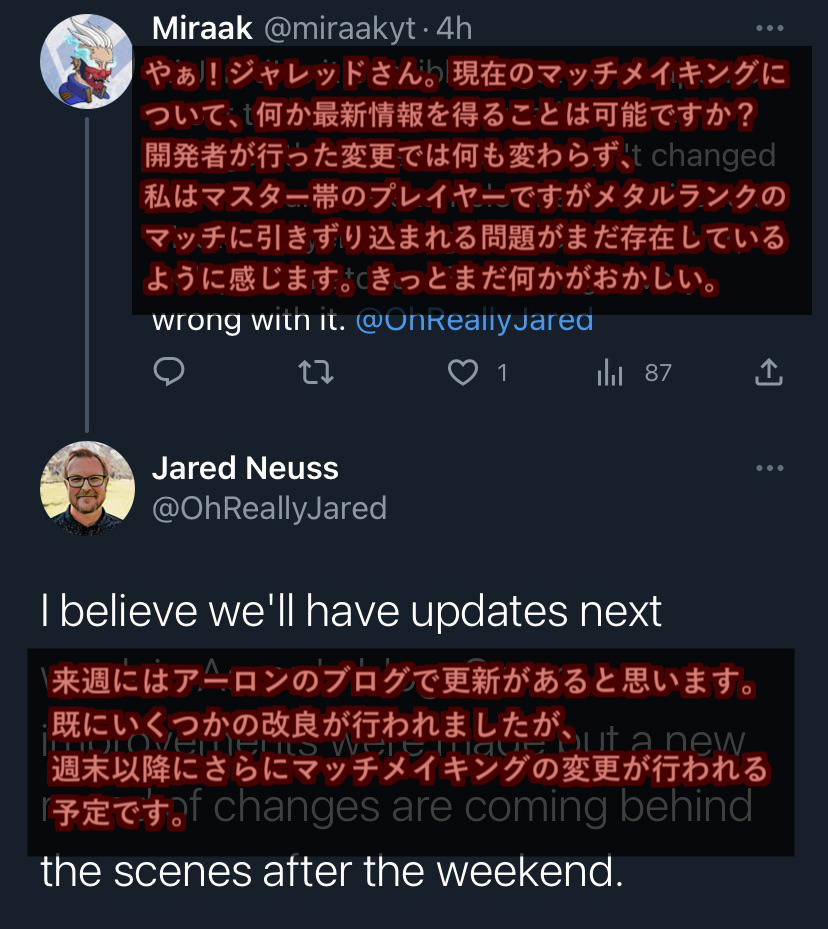

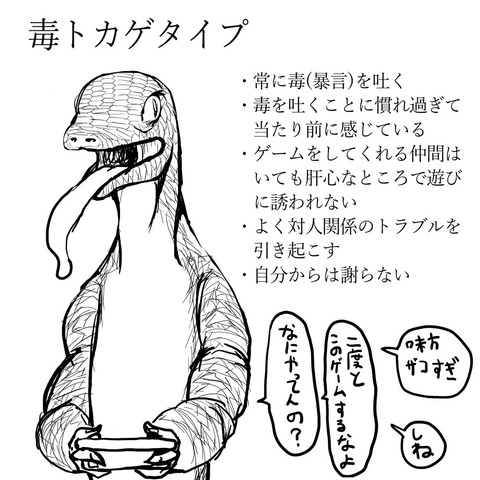

対人ゲームにいるプレイヤーの特徴的な4つのタイプという画像が話題にwwwww

引用元:

対人ゲーム(主に複数人対複数人系)のプレイヤーの特徴的なタイプを4つかいてみました。 https://t.co/ymfZx4cNqR

ワロタw完全に俺は毒トカゲタイプだわw

親の影響だと俺は思ってる

鳥タイプです

何かに折れてOWやらなくなったり、戻ってきたりしてます

亀やわ。

昔はトカゲやったけど、このゲームはキレても無駄って分かったから負けても平気になったわ。

鳥だわ

黙り過ぎて機嫌悪いのかって何度聞かれたことか

亀と鳥の真ん中ら辺だ

みんなと楽しく遊びたいけど上昇志向も相まってたまに困る

エンジョイとガチの間でせめぎ合ってる

ファンメでもvcでも毒を吐きまくる嫌な奴

ちんぱんはちょっと頭おかしいが悪い奴ではない

新着記事

関連記事

人気記事

💬コメント数:30

💬コメント数:30

💬コメント数:15

💬コメント数:15

💬コメント数:4

💬コメント数:4

💬コメント数:15

💬コメント数:15

💬コメント数:9

💬コメント数:9

💬コメント数:10

💬コメント数:10

💬コメント数:5

💬コメント数:5

💬コメント数:10

💬コメント数:10

💬コメント数:58

💬コメント数:58

💬コメント数:97

💬コメント数:97

💬コメント数:17

💬コメント数:17

💬コメント数:71

💬コメント数:71

💬コメント数:18

💬コメント数:18

💬コメント数:20

💬コメント数:20

💬コメント数:21

💬コメント数:21

💬コメント数:32

💬コメント数:32

💬コメント数:34

💬コメント数:34

💬コメント数:24

💬コメント数:24

💬コメント数:0

💬コメント数:0

💬コメント数:0

💬コメント数:0

💬コメント数:4

💬コメント数:4

💬コメント数:181

💬コメント数:181

💬コメント数:4

💬コメント数:4

💬コメント数:2

💬コメント数:2

今日の人気記事

Ultは英語音声のが好きなんだけど分かる人いる?

💬コメント数:34

ゲンジの木の葉返しでラインハルトの近接弾けるの納得できんわ→近接弾けるの知らんかったわ・・・

💬コメント数:24

【可愛い】D.Vaの1v1アーケードの本当の戦い方はこれだ!

💬コメント数:0

Eichenwaldeで自陣リスポから敵陣リスポ付近まで走れるウォールライドルート!

💬コメント数:0

ゲンジくん「ヤサイマシマシ」

💬コメント数:4

今週の人気記事

新ヒーローを即ピする方法www

💬コメント数:8

最近始めた初心者に最盛期ブリギッテの性能教えて震え上がらせたい

💬コメント数:38

よくぴょんぴょんジャンプしながら撃ってる人いるけど頭抜かれやすくならない?

💬コメント数:61

新着コメント

2025-11-19 10:12:12

セックス人形 https://ja.sexdollsoff.com

ダッチワイフ 高級

2025-11-14 08:17:26

ラブドール 素晴らしい ?私は間違いなくあなたのウェブサイトに感銘を受けて発音すべきです。一部の人にとっては、ダッチワイフはにらみつけるもののように見えるかもしれません、そして多くの個人は彼らが本物の女性に取って代わることはできないと述べています

2025-11-11 13:44:52

poupée sexuelle la plus réaliste https://fr.realsexdoll.com

カテゴリ

アーカイブ

ホーム

ホーム 人気記事

人気記事 おすすめ記事

おすすめ記事 新着コメント

新着コメント ランダム記事

ランダム記事

コメント

名無しのヒーロー

2017/05/05 9:15

血液型診断みたいなもん

名無しのヒーロー

2017/05/05 10:21

毒トカゲだったけど鳥タイプになったな。死体撃ちの常習犯だったけど上手い人にやり返されまくって「死体撃ちなんてやめておけ」みたいなことを言われて鳥タイプになった。

名無しのヒーロー

2017/05/05 11:11

味方依存のゲームだしowは毒率7割超えると思う

名無しのヒーロー

2017/05/05 11:23

亀だったがレート700近く下がってからトカゲになったなぁ( ˙-˙ )さすごにね?

名無しのヒーロー

2017/05/05 13:02

基本鳥だけど死んだり試合に負けたりすると一瞬だけ毒トカゲになるなぁ

名無しのヒーロー

2017/05/05 14:07

自分は鳥かなぁ、始める前に毎回エイム練習しないと気が済まないし、ここ最近OW自体やってないけど

名無しのヒーロー

2017/05/05 18:39

亀と鳥の間にもう1つあればそれかも、勝つために頑張るけどイライラもせず楽しくやってるし

名無しのヒーロー

2017/05/05 19:33

みんなチンパンでしょ

名無しのヒーロー

2017/05/05 20:08

「俺は鳥だな(チンパン」な人が多そう

自分を客観的に見れる人なんてあんまりいないしね

名無しのヒーロー

2017/05/06 15:58

9割が毒チンパンという事実

名無しのヒーロー

2017/05/08 14:06

鳥と亀の間くらい

ってかよくぐちゃぐちゃ悪口いいながら

プレイ出来るよね

敵の足音とか聞こえなくなりそう

名無しのヒーロー

2018/09/12 20:33

毒チンパンです

名無しのヒーロー

2018/10/31 16:07

ち ん ぱ ん